People were willing to do just about anything to get Dennis’s attention. Of all the approaches his students took to get themselves admitted to his trading school, Jim Melnick’s was the most extreme and inventive. He was an overweight, working-class guy from Boston who was living over a saloon in the Chicago suburbs. However, Melnick was determined to get as close to Dennis as possible. He actually moved to Chicago just because he’d heard about Richard Dennis.

He ended up as a security guard for the Chicago Board of Trade and every morning would say, “Good morning, Mr. Dennis” as Dennis entered the building. Then, boom, the ad came out and Melnick got selected. Dennis, who was loaded with millions and power, took a guy off the street and gave him the opportunity to start a new life. The story of Melnick is pure rags-to-riches. How did he know that getting that close to Dennis could lead to something? He didn’t, of course, but he hoped it would. His self-confidence was prophetic.

Another of Dennis’s students described Jim’s “everyman” qualities: “He reminded me of a truck driver and like magic became a ‘Turtle’ and he still couldn’t believe why or how…as far as where he is today, I have no clue at all.” Mike Shannon, a former actor who had left school at the age of sixteen, made it to Dennis’s door, too. He recalled, “I was working as a broker, and I was a very bad commodity broker.” Through a bunch of floor brokers Shannon found out about the ad, but he knew his résumé was problematic.

He had a solution to that: “I made up a phony resume, and I sent it off to Richard Dennis. I used the school of audacity to get the job.” People get fired or, at the very least, don’t get hired because of falsifying a résumé, but that was not how it worked with the eccentric head of C&D Commodities. On the other hand, Jim DiMaria, a Notre Dame graduate and family man straight from the Ozzie and Harriet back lot, was already on the trading floor working for Dennis when he applied.

DiMaria remembered that every now and again there would be a “1,000 lot” (jargon for a huge order of one thousand futures contracts) that would come through on the trading floor. Finally, he said, “Who is this client with the enormous orders?” He thought he’d heard it was a rich dentist, which was plausible since doctors often dabbled in trading. Eventually he put two and two together, realizing that Rich Dennis was the “rich dentist.” Dennis, however, was not looking solely for doormen and floor traders. He went after the highly educated, too. Michael Cavallo had a Harvard MBA. With a mop of brown hair and wire-rimmed glasses, he was a preppy corporate warrior working in Boston when he caught wind of the ad that would change his life. When he saw the ad, Cavallo had already heard of Dennis. He recalled, “I nearly fell out of my seat when I saw it. He was looking for starting shortstop. I couldn’t believe it. This is sort of a dream job for me. I immediately responded.” There was plenty of serendipity as other potential students learned of the experiment.

Former U.S. Air Force pilot Erle Keefer’s path to Dennis was pure coincidence as well. He was sitting in a New York City sauna when he picked up a newspaper and spotted the Dennis ad. At that moment the female star of the movie Trading Places, Jamie Lee Curtis, was sitting in the same sauna with her boyfriend. Keefer was sitting there reading Barron’s. “I am looking at this ad and I knew who Rich was. I said, ‘Wow! This guy did it.’ ” Keefer thought there was little chance he would get accepted. In the strictly man’s world of commodities trading in the early 1980s, women did apply.

Liz Cheval, the diminutive and flamboyant Katie Couric look-alike, was one of them. She must have known that she would stand out from other applicants by being female. At the time she was actively considering a career in filmmaking, even though she was working for a brokerage firm as a day job. Cheval’s former boss, Bradley Rotter, knew the offer was a big deal: “Dennis had already been managing money for me, and I did very well. Liz came to me and said she was thinking about applying and asked whether or not she should do it and I said absolutely. It was an opportunity of a lifetime.”

Jeff Gordon, an attorney and small business owner at the time, just happened to be thumbing through the newspaper and saw the ad. Gordon, five foot eight, a slender man who could have been a former member of the Revenge of the Nerds cast, knew the opportunity could be huge: “Everybody wanted to be able to trade, to make money like Richard Dennis.” Firing off a résumé was a coincidental and fortuitous life-changing decision that Gordon made in a heartbeat. Given Dennis’s eccentric personality, it was no shock that Jiri “George” Svoboda, an immigrant from then communist Czechoslovakia and a monster underdog in most people’s eyes, was selected. He was a master blackjack player beating Las Vegas like a drum long before Breaking Vegas and 1990’s famed M.I.T. blackjack team. Dennis also selected Tom Shanks.

TurtleTrader George Svoboda

Handsome, dark-haired, and smooth with the ladies, Shanks was working as a computer programmer for Hull Trading as his day job and beating Vegas at night with his blackjack skills. Shanks and Svoboda knew each other from the blackjack underground. When they bumped into each other in Chicago, Svoboda said to Shanks, “Hey, I’m here for an interview with Richard Dennis. Have you heard?” Shanks had no clue, but said, “You’ve got to get me an interview!” They both ended up getting hired that same afternoon. Erle Keefer knew about their wild backgrounds. He said, “George ran the Czech team, and Tom was essentially with the Dingo computer in a boot.” Shanks used to say, “I never want to see another Dingo boot in my life.” He had to learn how to take it apart to put the computer in and was mighty sick of boots after a while.

Other inventions allowed Shanks to be almost dead accurate as to the sequence of cards as they were dealt. How could Dennis not hire a guy who had put a computer in a boot during the 1970s? That effort just screamed, “Do anything to win.” Mike Carr, on the other hand, had built a name for himself at the role-playing game firm Dungeons and Dragons, where he developed a cult following with his “war-gaming” authorship. He had also developed a board game, “Fight In The Skies,” which modeled World War I–style air combat. He just happened to pick up the Wall Street Journal for the first time in six months and saw the ad. He called it “Divine Providence.”

Jerry Parker, who would make the cut, knew the potential life-changing ramifications of being selected. The unassuming accountant and evangelical Christian, with a proper side part to his hair, was not headed down the trading path prior to seeing the C&D ad. He said, “I was a small town person [from Lynchburg, Virginia] and Richard Dennis rescued me from leading a normal life.” Before any of the average-Joe pupils were officially “rescued,” as Parker had so aptly phrased it, they had to continue through the selection process. After sending in their résumés, applicants who made the first cut received a letter and a test. The letter was formal and utilitarian.

It reflected none of that Dennis “energy and spirit.” In by-the-book attorney-speak, it said if selected, Turtles would get 15 percent of the profits as salary after they completed a short training period and then a short trial trading period. All potential students were told that they would have to relocate to Chicago. Prospective students at this stage of the process were asked for their college entrance exam scores. If they didn’t have those, they needed to explain why. There was more. Candidates had to complete a 63-question true– false test. The true–false questions all appeared to be easy at first glance, but perhaps tricky on second thought:

1. One should favor being long or being short, whichever one is comfortable with.

2. On initiation, one should know precisely at what price to liquidate if a profit occurs.

3. One should trade the same number of contracts in all markets.

4. If one has $100,000 to risk, one ought to risk $25,000 on every trade.

5. On initiation, one should know precisely where to liquidate if a loss occurs.

6. You can never go broke taking profits.

7. It helps to have the fundamentals in your favor before you initiate.

8. A gap up is a good place to initiate if an uptrend has started.

9. If you anticipate buy stops in the market, wait until they are finished and buy a little higher than that.

10. Of three types of orders (market, stop, and resting), market orders cost the least skid.

11. The more bullish news you hear and the more people are going long, the less likely the uptrend is to continue after a substantial uptrend.

12. The majority of traders are always wrong.

13. Trading bigger is an overall handicap to one’s trading performance.

14. Larger traders can “muscle” markets to their advantage.

15. Vacations are important for traders to keep the proper perspective.

16. Under trading is almost never a problem.

17. Ideally, average profits should be about three or four times average losses.

18. A trader should be willing to let profits turn into losses.

19. A very high percentage of trades should be profits.

20. A trader should like to take losses.

21. It is especially relevant when the market is higher than it’s been in 4 and 13 weeks.

22. Needing and wanting money are good motivators to good trading.

23. One’s natural inclinations are good guides to decision making in trading.

24. Luck is an ingredient in successful trading over the long run.

25. When you’re long, “limit up” is a good place to take a profit.

26. It takes money to make money.

27. It’s good to follow hunches in trading.

28. There are players in each market one should not trade against.

29. All speculators die broke.

30. The market can be understood better through social psychology than through economics.

31. Taking a loss should be a difficult decision for traders.

32. After a big profit, the next trend-following trade is more likely to be a loss.

33. Trends are not likely to persist.

34. Almost all information about a commodity is at least a little useful in helping make decisions.

35. It’s better to be an expert in one to two markets rather than try to trade ten or more markets.

36. In a winning streak, total risk should rise dramatically.

37. Trading stocks is similar to trading commodities.

38. It’s a good idea to know how much you are ahead or behind during a trading session.

39. A losing month is an indication of doing something wrong.

40. A losing week is an indication of doing something wrong.

41. The big money in trading is made when one can get long at lows after a big downtrend.

42. It’s good to average down when buying.

43. After a long trend, the market requires more consolidation before another trend starts.

44. It’s important to know what to do if trading in commodities doesn’t succeed.

45. It is not helpful to watch every quote in the markets one trades.

46. It is a good idea to put on or take off a position all at once.

47. Diversification in commodities is better than always being in one or two markets.

48. If a day’s profit or loss makes a significant difference to your net worth, you’re overtrading.

49. A trader learns more from his losses than his profits.

50. Except for commission and brokerage fees, execution “costs” for entering orders are minimal over the course of a year.

51. It’s easier to trade well than to trade poorly.

52. It’s important to know what success in trading will do for you later in life.

53. Uptrends end when everyone gets bearish.

54. The more bullish news you hear, the less likely a market is to break out on the upside.

55. For an off-floor trader, a long-term trade ought to last three or four weeks or less.

56. Others’ opinions of the market are good to follow.

57. Volume and open interest are as important as price action.

58. Daily strength and weakness is a good guide for liquidating long-term positions with big profits.

59. Off-floor traders should spread different markets of different market groups.

60. The more people are going long, the less likely an uptrend is to continue in the beginning of a trend.

61. Off-floor traders should not spread different delivery months of the same commodity.

62. Buying dips and selling rallies is a good strategy.

63. It’s important to take a profit most of the time.

Not all the questions were true or false. Dennis also asked candidates essay questions:

1. What were your standard test results on college entrance exams?

2. Name a book or movie you like and why.

3. Name a historical figure you like and why.

4. Why would you like to succeed at this job?

5. Name a risky thing you have done and why.

6. Explain a decision you have made under pressure and why that was your decision.

7. Hope, fear, and greed are said to be enemies of good traders. Explain a decision you may have made under one of these influences and how you view that decision now.

8. What are some good qualities you have that might help in trading?

9. What are some bad qualities you have that might hurt in trading?

10. In trading would you rather be good or lucky? Why?

11. Is there anything else you’d like to add?

Dennis placed the passion to achieve at the top of his list. You have to wake up with that inner drive and desire to make it happen. You have to go for it.

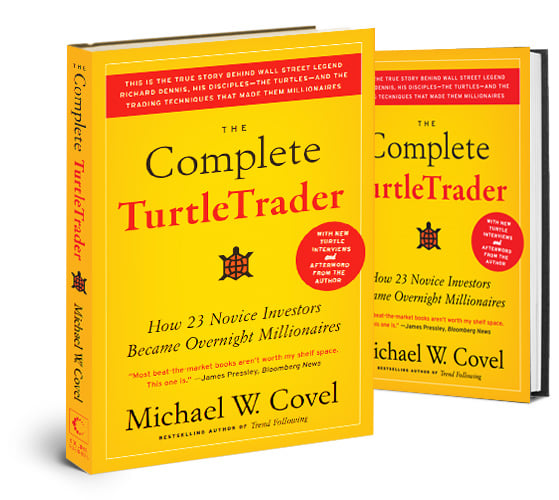

Read it all: