Trading for exceptional returns may not appear realistic in the schizophrenic cacophony:

“What is the right approach for investors faced with an unusually uncertain economic outlook and volatile markets?”

“Big concerns over job insecurity, consumer and corporate spending, and housing prices.”

“Should you buy gold?”

“Where are markets headed?”

“Oil shock, dollar drop, Japanese earthquake, elections!”

That’s white noise.

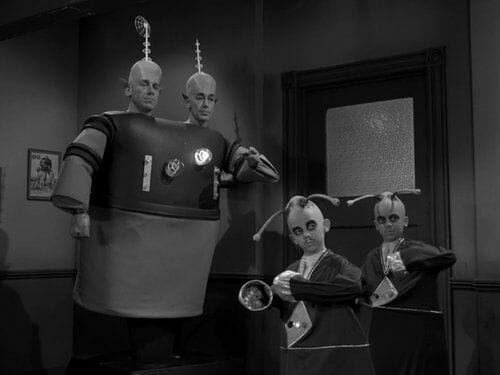

Yes, sure, of course, you may have more options, but an explosion of naiveté has muddied the waters. Ignorance and confusion reign supreme. The idiot box is no longer just the bedroom flat screen. It is every PC, Mac, iPhone, and iPad. People absorb TMZ and Drudge via an intravenous drip. We are in a voyeuristic world where living vicariously through someone or something is accepted without hesitation and, in fact, encouraged.

With brain synapses bombarded nonstop, it is no surprise that this has brought attention spans down to just a few seconds—about the same as a goldfish. However, an incessant barrage of information across every known connected device will not punch your ticket to financial freedom. Retirement plans that have elderly dining on cat food, buying gold because you are scared, canning food, and setting up a crisis garden are not solutions. If that’s your direction, this book is a tough love punch to your gut. Brutal honesty about what it takes to get ahead with your money is coming in these pages like a hard rain. There is no reason to continue on the hamster wheel. You simply need a winning philosophy and strategy, backed by proven positive results that you can execute. Push the pause button.

In the film Contact, Jodie Foster plays a character called Ellie, a scientist who cannot figure out an alien signal from the deep reaches of outer space until she finds the key—the “primer.” Finally she receives help from a Carl Sagan-like benefactor named S. R. Hadden:

Hadden: The powers that be have been very busy lately, falling over each other to position themselves for the game of the millennium to decipher the alien signal. Maybe I can help deal you back in.

Ellie: I didn’t realize that I was out.

Hadden: Oh, maybe not out, but certainly being handed your hat. I have had a long time to make enemies Doctor…and I wish to make a small contribution. A final gesture of goodwill to the people of this planet….

Ellie: You’ve found the primer!

Hadden: Clever girl.

Today, John W. Henry is the owner of the Boston Red Sox baseball team. He also now owns the famed Liverpool Football Club in Britain. Red Sox price: $700 million. Liverpool: $476 million. He is not broke. How did he make that fortune?

Trading in a very rigid, rules-defined, way. In 1995, Henry, a former farmer from Arkansas who began his trading career humbly hedging his crops, made speculative trading history. His trading strategies essentially won the money lost by rogue trader Nick Leeson of Barings Bank (often referred to as the “Queen’s bank”). Leeson bet wildly and lost $1.3 billion. The Queen’s bank collapsed. Leeson was the Time cover boy. Media ate up the bank’s implosion and coverage was nonstop. Leeson was the known loser. Henry was the then-unknown winner.

Henry won practicing a form of trading called systematic trend following. His big win was never revealed (see my first book, Trend Following). Some tight insiders knew, but with detective-like probing, I outed Henry’s win. Just like S. R. Hadden, the primer to Henry’s moneymaking system was deep in my mind and gut.

But money success is much more than some event in the long ago dotcom era. It is about an ongoing profit system that reaps spoils when markets crash and fear cascades—as in 2008. It’s also about finding big trends to ride even when there is no panic or crisis. Trend following, however, is not theoretical or academic wonk talk. There are decades of substantial performance proof.

Big money making starts with trends, or waves. Anyone who makes significant money rides waves. And guess what? No one can predict the next big one. The only certainty is that when the big wave comes, trend followers will surf the new beaches.

That simple-sounding ideology is instrumental for financial flexibility, as trend followers trade that same philosophy in all markets. You can storm into any moving market, be it an obscure currency or a stock in wild emerging markets. Trend following is agnostic to both the market and direction. It is a James Bond “007 license” to pursue whatever market is flowing up or down.

Now, decades after outsmarting the Queen’s bank, John W. Henry and his trend trading peers still operate in an essentially secretive underground society, a financial parallel world. Henry’s accomplishments are astounding, but many of his trend-trading peers have also killed it. Traders such as David Harding, Ken Tropin, Louis Bacon, and Bruce Kovner have become billionaires trading unpredictable trends. And don’t forget the TurtleTraders.

Additionally, mysterious firms not built around individual names, are also making trend-chasing fortunes. Sunrise Capital, Transtrend, BlueCrest, Altis Partners, Aspect Capital, and Man Investments just to name a few, are some of today’s top traders, pulling billions in profits out of the markets—quietly and effectively. While seemingly everyone else is mainlined into the matrix for a daily fix of mutual funds, news, and government, trend traders keep on keeping on. But this is not about hero worship; it’s about learning from winners.

John W. Henry was recently asked how he did that—meaning make the money. He quipped, “I didn’t do that. Mathematical formulas did that. It’s made through trend following.” The interviewer noted that the U.S. dollar was down and asked if he bet against it. Henry replied with a smile, “Right, very good.” The interviewer said, “I don’t get that.” Henry with a touch of sarcasm added, “Neither will your readers.”

If you are thinking that I have inserted a conspiracy theory, X-Files, or Area 51 edge to trend following, smart thinking. Trend traders are dialed in and average investors are lost? Indeed. Many investors today hide their money under mattresses. Everything that used to be safe is now risky. Real estate has cratered. Stocks are up one day, and down the next. Politicians on both sides of the aisle are just fear mongers. And let’s not forget about salesmen hawking gold as a hedge against the end times.

Don’t fret! There is good news. Trend following is real hope. It is the primer that unlocks the path of trend trading.

Trend following is a new vantage. The style is different. Sadly, many still see making money wrong. They make wildly inaccurate assumptions about what constitutes a winning trader:

• Do they possess a unique talent?

• A special inborn gene or divine gift?

• The innate talent of a child prodigy?

• Inside knowledge?

• Ability to predict markets?

• Degrees in finance or an MBA?

• Huge starting capital?

One answer: No.

Why do we not know that? Instant gratification is our Achilles’ heel. Multitask this and that. Kardashians. Now. Faster. Easier. Patience is a four-letter word.

How does the latest iPad help you to make money trading the markets? How does attending a Code Pink or Tea Party rally help? How does connected 24/7 help you? Your favorite blog, fancy broker tools…all will do what? How does electing your favorite politician help you to make money?

Let’s be honest. It’s all about you. It’s you, your friends, and your family against the world.

Trend following is for people who want above and beyond an average. It’s about getting wealthy and thriving. Now, faster, and easier doesn’t work for market prosperity. That’s not strategy. Trend following traders don’t play that way, and neither should you.

Ten years ago, Jason Fried of 37signals.com was hired as my first pro web site designer. He has since moved on to ventures far exceeding simple web site design, so it was very random that his book Rework inspired me. His big question made me think:

“Taking a stand always stands out. Who do you want to take a shot at?”

A valid question. My answer: Wall Street, the government, and media for starters.

Let go of them.

That is a breath of fresh air in an era of constant depression and recession talk, nonstop predictions, clueless economists, and Federal Reserve Ponzi schemes. Trend following is for those who know deep down that there is a real way to make money in the markets, but just do not know how yet. However, you will be surprised that the secret is hiding in plain sight. There was a great story on author Seth Godin’s web site. He had a college professor who worked as an engineering consultant. There was a 40- story office tower in Boston with a serious problem—an unsightly dark smudge was coming through the drywall. The multimillion-dollar fix would be to rip out all the drywall. Godin’s former professor was hired in a lastditch effort. He said, “I think I can fix it, but it will cost you $45,000.” The owners instantly agreed. The professor wrote down the name of a common hardware store chemical. “Here,” he said and sent a $45,000 bill. It was a bargain.

I’ve had a one-of-a-kind educational journey. My books Trend Following and The Complete TurtleTrader have sold more than 250,000 copies (no bragging, just for reference). My documentary film Broke outlined the Great Recession from a trend following perspective. Look, you might argue against my words, but arguing against my passion and research will be exhausting. Trust me, but verify every word herein. Accept nothing without questioning why. Find holes in the arguments, and when you can’t, send me a thank you card. You want confidence and inspiration? It’s here.